Why This Matters

Most roadmaps fail for one reason: they’re treated as a list of projects instead of a capital allocation plan. The cost isn’t just time—it’s missed quarters, delayed revenue, and wasted engineering focus.

If your roadmap can’t answer four questions in 60 seconds—revenue vs activity, quarterly risk, alignment, and near-term outcomes—you don’t have a roadmap. You have a backlog.

The Roadmap Capital Allocation System

This system has four steps. The goal is not “better planning.” The goal is fewer wrong bets.

- See the portfolio: where are bets clustered, what’s high impact, what’s misaligned?

- Diagnose decision-readiness: conviction, ownership, dates, and risk.

- Decide with a queue: Ship / Block / Defer.

- Fix the bottleneck: upgrade evidence, assign owners, add dates, reduce concentration.

Decision-Ready Clarity: The 6 Signals That Matter

If you only track one thing, track decision-readiness—the probability that “what we plan” converts into “what we ship” with business impact.

1) Concentration

Theme distribution reveals risk. If one stream dominates, you’re overexposed and likely underfunding a constraint (often monetization or reliability).

2) Conviction

Conviction is clarity + evidence. Low conviction isn’t a failure—unless you keep approving net-new scope anyway.

3) Trend (21 days)

Trend shows whether the roadmap is improving. “Stable” can be good—or it can mean you’re stuck.

4) Timeline Coverage

Dated PRDs are sequenceable. Undated PRDs are opinion. If dates are missing, delivery becomes guesswork.

5) Ownership Coverage

Ownership is how alignment becomes enforceable. Without owners, you can’t hold the roadmap accountable.

6) Silo / Dependency Risk

Cross-team dependencies are where quarters die. If risk is high, you need owners + dependency dates before launch sign-off.

Walkthrough: A Real Roadmap Direction Report (Founder-Readable)

Here’s how this looks in practice when ProdMoh generates a Roadmap Direction summary from the Product Canvas:

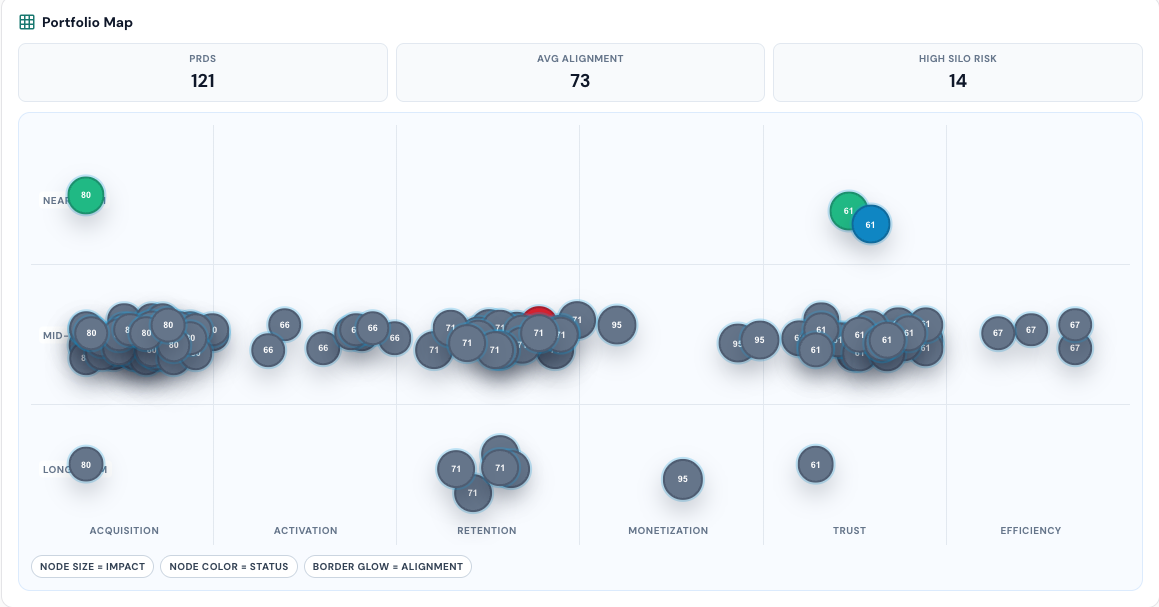

Roadmap is concentrated in acquisition with trust as the secondary stream.

Execution horizon is mid-term heavy (90%), with moderate launch immediacy.

Conviction is 51/100 (Needs Clarity) with high signal quality.

Trend over 21 days is stable (+0).

Target-date coverage is 3% (3/117 PRDs dated).

Prioritize revenue impact, ownership clarity, and risk controls before net-new scope.Portfolio Concentration

Acquisition: 44% (51/117)

Trust: secondary stream

Monetization depth: 3% (4/117)You’re optimizing for top-of-funnel, but your revenue surface area is thin. The remedy is not “add more.” It’s rebalance and pull 1–2 monetization bets forward.

Founder Fast Answers

- Are we building revenue now or just activity? HIGH — monetization depth is low (4/117). Add 1–2 near-term conversion bets.

- What can hurt this quarter if we ship as-is? MEDIUM — 15/117 PRDs have high silo risk. Resolve owner + dependency dates before sign-off.

- Are teams aligned to organizational goals? HIGH — 114/117 PRDs are unassigned. Alignment can’t be enforced until ownership is mapped.

- Will this roadmap produce visible outcomes soon? HIGH — near-term delivery is 3%. Shift 1–2 PRDs to near-term if this quarter matters.

The Decision Queue: Ship / Block / Defer

The Decision Queue is the simplest founder tool for preventing runway burn. It converts vague ambition into clear gating.

BLOCK: Ownership

Pause net-new roadmap intake until PRD ownership is assigned (114/117 unassigned).

Owner: Head of Product • Due: 2026-02-27

Metric: Unassigned PRDs ≤ 10% (currently 97%)BLOCK: Target Dates

Fill missing target dates for 114 PRDs before confirming release sequencing.

Owner: Head of Product • Due: 2026-03-02

Metric: Target-date coverage = 100% (currently 3%)BLOCK: Conviction

Roadmap conviction is 51/100. Block net-new bets until evidence quality improves.

Owner: Head of Product • Due: 2026-02-27

Metric: Roadmap conviction ≥ 70 with high evidence signalBlocking isn’t bureaucracy. It’s capital discipline. You’re preventing months of engineering spend on bets that aren’t ready to sequence or verify.

Remedy Map: If the Signal Is Bad, Do This

Use these as “default fixes.” They’re designed to be executed in days—not quarters.

- Concentration is high → cap net-new intake in the dominant stream until balancing bets exist.

- Monetization depth is thin → add 1–2 near-term conversion bets tied to measurable revenue KPIs.

- Ownership coverage is low → “no owner, no roadmap”: assign accountable owners before sequencing.

- Timeline coverage is low → date hygiene sprint: fill target dates + dependency dates before release plans.

- Conviction < 70 → upgrade evidence tiers (external validation + kill criteria) before net-new scope.

- Silo risk is high → map dependencies + set integration deadlines before launch sign-off.

How ProdMoh Creates This From the Product Canvas

ProdMoh’s Product Canvas turns PRDs into a structured system that can generate:

- Portfolio Map — see concentration, impact, alignment, and status at a glance.

- Roadmap Direction — founder-readable portfolio diagnosis + warnings.

- Decision Queue — Ship/Block/Defer gating with owners, due dates, and metrics.

Decision-ready clarity that makes it hard to waste engineering time—and easy to invest in bets that move the needle.

The 15-Minute Founder Roadmap Review (Weekly Cadence)

- Scan concentration — are we overfunding one stream?

- Check monetization depth — do we have revenue bets now?

- Review ownership + dates — can we sequence delivery credibly?

- Inspect risk — any high silo risk without owners/dates?

- Update Decision Queue — what gets shipped, blocked, or deferred this week?

FAQs

What should I block first if the roadmap is messy?

Block net-new intake until ownership is assigned and target dates exist. Without those, alignment and sequencing are not enforceable.

How many monetization PRDs should a healthy roadmap have?

There’s no universal percentage, but “near-zero” is a red flag. If monetization depth is ~3% (like 4/117), add 1–2 near-term conversion bets before your next planning cycle.

What does “conviction 51/100” mean?

It signals that the roadmap has high signal quality but needs clarity/evidence upgrades. The right move is to improve validation and constraints before expanding scope.

Build What Moves the Needle

If you want your roadmap to behave like a capital allocation plan—complete with concentration warnings, conviction scoring, and a Ship/Block/Defer Decision Queue—ProdMoh generates it from your Product Canvas.